kern county property tax payment

Ad Find The Kern County Property Tax Records You Need In Minutes. KCTTC Payment Center PO.

Kern County Taxpayers Association Kern County Taxpayers Association

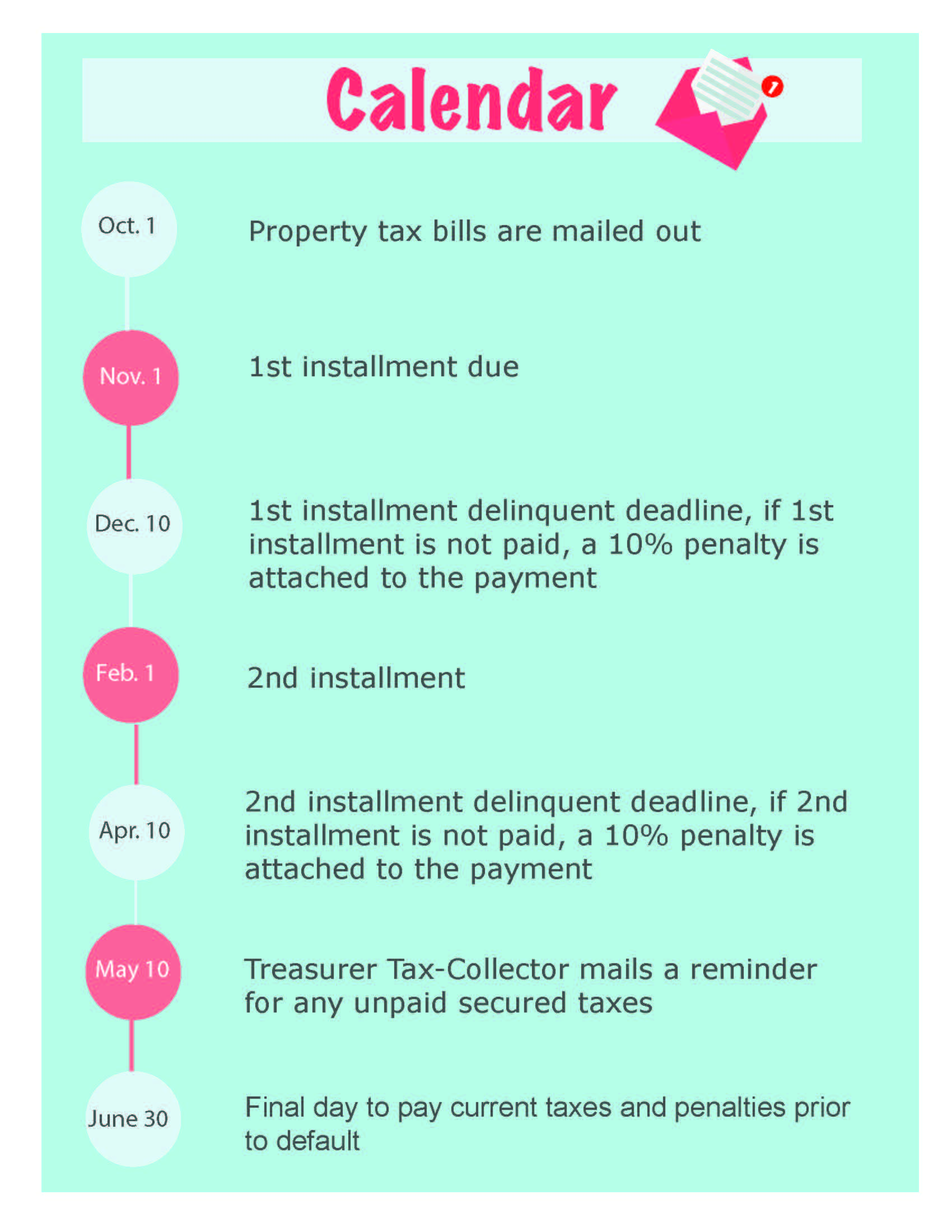

Secured tax bills are paid in two installments.

. 1115 Truxtun Avenue Bakersfield CA 93301-4639. Kern County CA Home Menu. Taxation of real property must.

Visit Treasurer-Tax Collectors site. Change a Mailing Address. 800 AM - 500 PM Mon-Fri 661-868-3599.

Pay Property Taxes Kern County CA. The first installment is due on February 1 and the second installment is due on May 1. If the bank pays your.

Auditor - Controller - County Clerk. Riverside County homeowners pay a median annual property tax payment of 3144. Start by looking up your property or refer to your tax statement.

Property 5 days ago Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Contact us to get your current balance if you have multiple lien tax debt. You can also pay online.

Dec 8 2021. Find The California Property Records You Need Online. Property Taxes - Pay Online.

When it comes to paying their property taxes residents have a couple of options. Website Usage Policy Auditor - Controller -. 10 according to a press release from Jordan Kaufman the countys treasurer and tax collector.

Kerr County Tax Office Phone. Ad Pay Your Taxes Bill Online with doxo. Stay Connected with Kern County.

You can mail your payments to the Kern County treasurer and tax collector at. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted. The first installment is due on 1st.

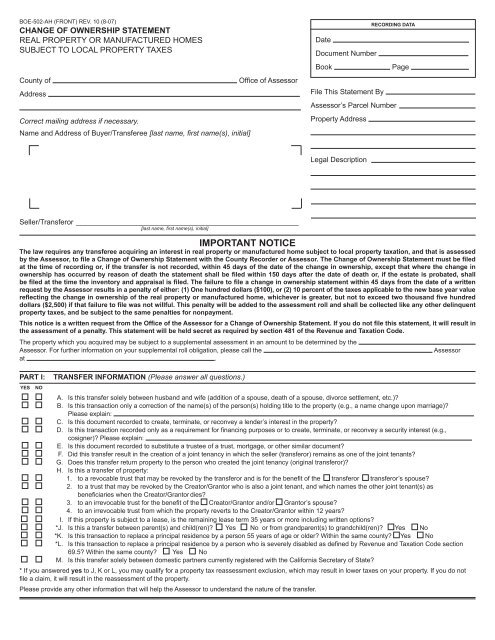

Kern County property taxes are due on November 1 of each year. Senate Bill 813 enacted on July 1 1983 amended the California Revenue and Taxation Code to create what are known as Supplemental. Box 541004 Los Angeles CA 90054.

Riverside County homeowners pay a median annual property tax payment of 3144. Look up your property here 2. Kern County Assessor-Recorder County Terms of Sale.

You can pay your property taxes online with a valid debit or credit card using Kern. Supplemental Assessments Supplemental Tax Bills. Property Tax Rates Report.

Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE. The current owner of tax-defaulted property subject to sale under.

If either of these. Kern County real property taxes are due by 5 pm.

Kern County Treasurer Secured Property Tax Bills Mailed Kern Valley Sun

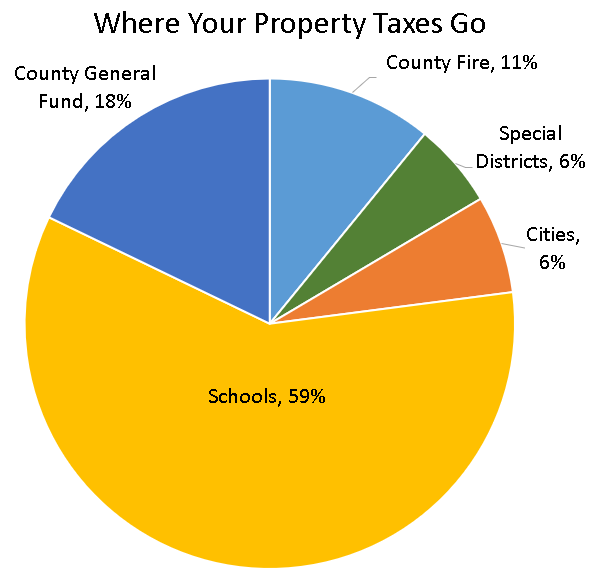

Oil Gas Play Key Role For Kern County Public Finances Nicholas Institute For Energy Environment Sustainability

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Important Notice Kern County Assessor Recorder

Sherburne County Moves To Abate Penalties For Late Property Tax Payment Kstp Com Eyewitness News

Kern County Treasurer Delinquent Property Taxes Due June 30 Kern Valley Sun

Kern County Treasurer And Tax Collector

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

Kern County News Roundup Property Tax Bills Running Late Official Christmas Tree Kernville Chamber Recognition Kern Valley Sun

Kern County Sheriff Restraining Order Form Fill Out Pdf Forms Online

Kern County Treasurer And Tax Collector

Tax Breaks Allow Kern S Solar Industry To Pay Far Less Property Tax Than Oil Ag And Wind Kbak

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Auditor Controller County Clerk

Kern County Property Taxes Are Due Friday Dec 10 Kern Valley Sun