does idaho have capital gains tax

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and. Uppermost capital gains tax rates by state 2015 State State uppermost rate.

1031 Exchange Idaho Capital Gains Tax Rate 2022

The capital gains rate for Idaho is.

. Up to 15 cash back Experience. The rates listed below are for 2022 which are taxes youll file in 2023. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

The table below summarizes uppermost capital gains tax rates for Idaho and neighboring states in 2015. Your average tax rate is 1198 and your marginal tax rate is 22. Wages salaries 100000 Capital gains - losses -50000.

Does idaho have capital gains tax on. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Right off the bat if you are single they will allow you to exclude 250000 of capital gains.

States have an additional capital gains tax rate between 29 and 133. Does Idaho have an Inheritance Tax or an Estate Tax. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

If you sold your home for 500000 you would not pay capital gains taxes on the entire 500000. A majority of US. The District of Columbia moved in the.

You would only pay the tax on the profit on your home if its above a specific. The percentage is between 16 and 78 depending. Idaho Income Tax Calculator 2021.

208 334-7660 or 800 972-7660 Fax. State Tax Commission PO. A homeowner with a property in.

The Idaho Income Tax. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. Object Moved This document may be found here.

Idaho does not levy an inheritance tax or an estate tax. County tax rates range throughout the state. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly.

Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801.

Individual Capital Gains And Dividends Taxes Tax Foundation

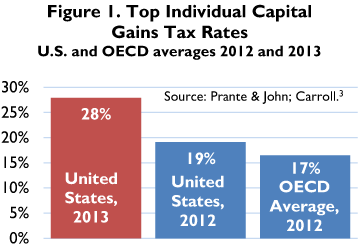

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Gubernatorial Candidate Dave Reilly From Idaho Declares He Would Abolish Property Capital Gains And Income Tax For Idahoans Who Use Bitcoin R Bitcoin

Capital Gains Tax Calculator Estimate What You Ll Owe

2021 Capital Gains Tax Rates By State

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

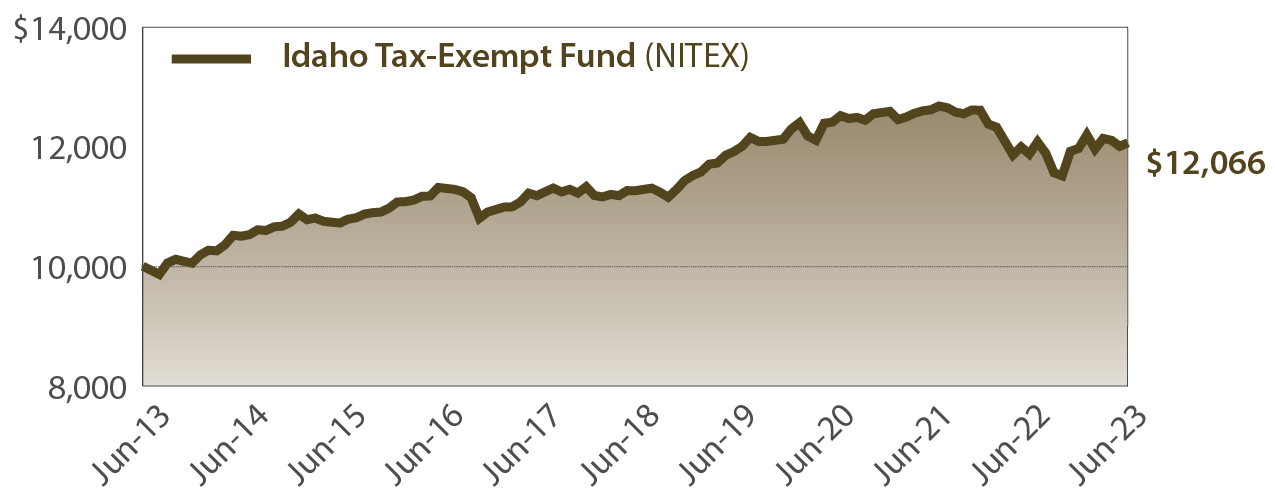

Idaho Tax Exempt Fund Saturna Capital

How High Are Capital Gains Taxes In Your State Tax Foundation

Form Cg Idaho Capital Gains Deduction

Crypto Capital Gains And Tax Rates 2022

State Taxes On Capital Gains Center On Budget And Policy Priorities

2022 Capital Gains Tax Rates Federal And State The Motley Fool

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Capital Gains Tax Calculator 1031 Crowdfunding

The Ultimate Guide To Idaho Real Estate Taxes

Idaho Opportunity Zones Oz Funds Investing Id Tax Benefits

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun